At Morgan Stanley, our premier brand, sturdy assets and market Management can give you a new possibility to grow your practice and carry on to fulfill on the motivation to provide tailor-made wealth management guidance that can help your customers access their financial goals.

The greater you allocate to stocks, the upper your portfolio's predicted risk/reward. The greater you allocate to bonds, the reduced your portfolio's anticipated risk/reward.

And lastly you can find risks connected with Real Estate Investment Trusts (REITs), such as REITs will probably be issue for the risks involved with the direct possession of housing, such as fluctuations in the value of fundamental Houses, defaults by borrowers or tenants, changes in desire prices and risks connected to normal or area economic ailments. REITs are subject to selected added risks, as an example, REITs are dependent upon specialised management expertise and hard cash flows, and can have their investments in relatively several Houses, a little geographic spot or one property kind.

Fidelity doesn't give lawful or tax information, and the data furnished is normal in nature and should not be viewed as legal or tax guidance. Consult with a lawyer, tax Skilled, or other advisor regarding your certain authorized or tax circumstance.

Responses provided by the virtual assistant are to help you navigate Fidelity.com and, as with any Web search engine, it is best to evaluation the results cautiously. Fidelity isn't going to promise precision of outcomes or suitability of data presented.

Precisely what is Diversification? Diversification is actually a battle cry For a lot of financial planners, fund managers, and individual buyers alike. It is just a management technique that blends different investments in one portfolio.

A personalized approach to wealth management that starts off with your objectives and consists of key components of your financial everyday living.

It is necessary to be aware of the variances when determining which products and/or services to pick out.

Fidelity Investments and its affiliate marketers, the fund’s sponsor, haven't any legal obligation to provide financial aid into the fund, and you shouldn't assume which the sponsor will offer financial assistance on the fund at any time. Worldwide stocks Shares issued by non-US companies generally carry out in a different way than their US counterparts, providing exposure to alternatives not supplied by US securities. For anyone who is looking for investments that offer equally increased potential returns and better risk, you may want to look at including some international shares towards your portfolio.

A individually managed account that gives a personalised direct indexing technique which may be individualized and allows for computerized tax-reduction harvesting.*

You could shape your portfolio's predicted risk/reward by switching the amount of cash you helpful hints allocate to shares and bonds.

We've got global expertise in market Assessment As well as in advisory and capital-increasing services for firms, institutions and governments.

The long term portfolio has precisely the same investment goal as the Tax-efficient retirement planning all-weather conditions portfolio — to perform nicely underneath any list of market conditions — but utilizes one a lot less fund.

An annuity is usually a style of insurance plan contract which will dietary supplement your retirement go to my site savings. There are lots of forms of annuities to decide on from, but we believe that fixed annuities are your best option.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Matilda Ledger Then & Now!

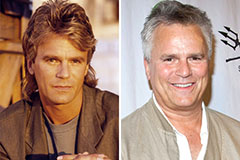

Matilda Ledger Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!