But that doesn’t suggest it is best to just dump all your cash to the market now. It could go up or down quite a bit inside the short-term. Rather, it’s much more prudent to speculate regularly, every 7 days or every month, and preserve introducing money after some time.

This group of investment assets continues to be developing lately. As it has, far more options have arisen for smaller traders to participate.

Who will be they excellent for?: In case you’re not quite up for investing the time and effort examining specific stocks, then a inventory fund – possibly an ETF or perhaps a mutual fund – could be a excellent choice.

Gold has very long been the go-to hedge against inflation. As inflation rises, currencies are likely to lose price, but gold usually moves in the opposite course. This is due to its scarcity and common acceptance like a worthwhile asset.

Threats: The pitfalls of a robo-advisor rely quite a bit on the investments. If you buy a lot of inventory cash since you Have a very large threat tolerance, you'll be able to anticipate a lot more volatility than if you buy bonds or keep profit a savings account. So, the chance is in Whatever you own.

The purpose of passive investing is to repeat, or monitor, the return reached by a specific inventory market index, applying desktops to take care of a portfolio of shares that replicates the general performance of your focus on index in question.

Their share rates are more unlikely to have problems with significant swings than newer, smaller sized companies, and several – especially those from ‘defensive’ sectors for instance Power, utilities and mining – may possibly pay back dividends.

The same way is to invest in real estate property investment trusts or REITs. These are funds that make investments largely in industrial housing. That will contain Office environment structures, retail Web Site Room, huge condominium complexes, and identical properties.

Benefit shares are contrasted against development stocks, which are likely to improve faster and exactly where valuations are larger.

There are actually numerous forms of bonds. Traditionally, particular bonds have already been viewed as considerably less dangerous than investing in shares or shares-centered funds, mainly because they supply common profits payments and entitle their homeowners to receive payment right before shareholders if an organization folds.

The truth is, retail giant Amazon began as a small-cap stock, and produced buyers who held on into the inventory extremely wealthy indeed.

Investing for the long term also ensures that you don’t really need to give attention to the market all the time just how that small-phrase traders do. You'll be able to invest your money on a regular basis on autopilot, after which you can commit your time and effort on things check these guys out that you truly adore in lieu of worrying in regards to the market’s moves.

Housing is always competing with the inventory market as the most beneficial lengthy-phrase investment automobile. In 2024, that Opposition demonstrates no signs of changing whenever shortly.

Long-expression investments Present you with the chance to receive greater than you can from shorter-expression investments. The catch is that you have to have a very long-phrase viewpoint, and not be terrified out from the market because the investment has fallen or simply because you would like to market for a quick financial gain.

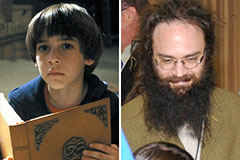

Barret Oliver Then & Now!

Barret Oliver Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!